Dollar Cost Averaging (DCA) in Crypto: Strategy & Calculator

Dollar Cost Averaging (DCA) in cryptocurrency: strategy, benefits, and how to implement a DCA plan.

Dollar Cost Averaging (DCA) in Crypto

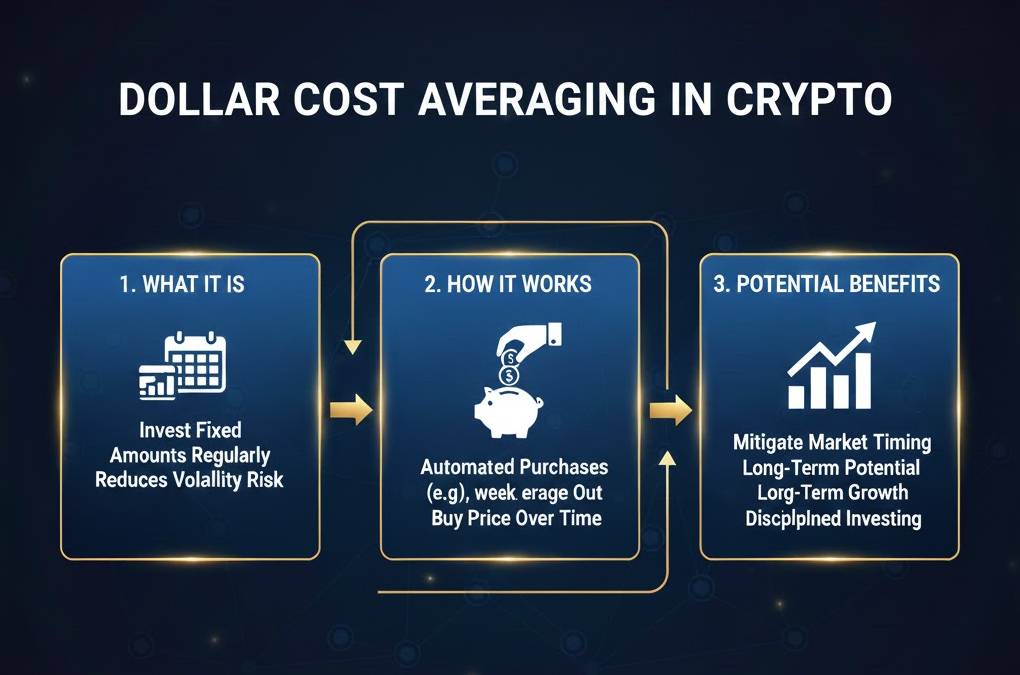

Dollar Cost Averaging (DCA) reduces the impact of volatility by investing fixed amounts at regular intervals. This guide explains why DCA works and how to implement it with our DCA calculator.

What is DCA?

DCA means investing the same amount of money at regular intervals (e.g., weekly or monthly), regardless of the asset price. Over time, this can lower the average purchase price and reduce risk from market timing.

How to Use DCA

- Choose an investment amount and interval (weekly/monthly).

- Select the asset(s) you want to buy.

- Automate purchases where possible via exchanges or recurring buys.

- Stick to the plan through market ups and downs.

Benefits & Drawbacks

DCA reduces emotional trading, smooths entry prices, and is particularly useful in volatile markets. However, it may underperform lump-sum investing in long-term bull markets.